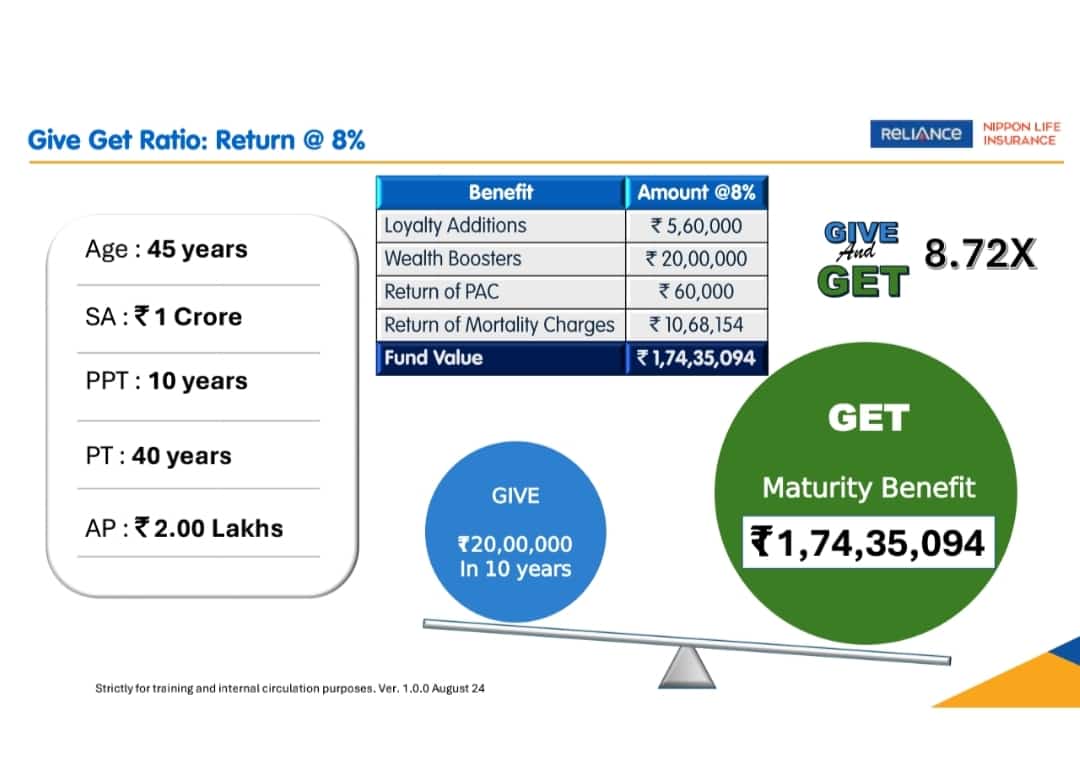

Policy Information:

Age: 45 years

Sum Assured (SA): ₹1 Crore

Premium Paying Term (PPT): 10 years

Policy Term (PT): 40 years

Annual Premium (AP): ₹2 Lakhs

Benefits at 8% Return:

Loyalty Additions: ₹5,60,000

Wealth Boosters: ₹20,00,000

Return of PAC (Policy Administration Charges): ₹60,000

Return of Mortality Charges: ₹10,68,154

Fund Value at 8%: ₹1,74,35,094

Give: ₹20,00,000 (total premium paid over 10 years)

Get (Maturity Benefit): ₹1,74,35,094

Give to Get Ratio: 8.72x

This policy seems to be a long-term investment insurance product where the policyholder contributes ₹2,00,000 per year for 10 years, and over the course of 40 years, the maturity value could reach ₹1,74,35,094 at an assumed return of 8%.