Bhandan Growth 10X Multi Asset Allocation Fund Invest Smartly. Grow Rapidly.

Are you ready to unlock your financial potential?

- Proven investment strategies.

- Managed by experienced professionals.

- Tailored for ambitious investors like you.

Invest now and take a step towards a brighter financial future!

More Bhandan Growth 10X Multi Asset Allocation Fund

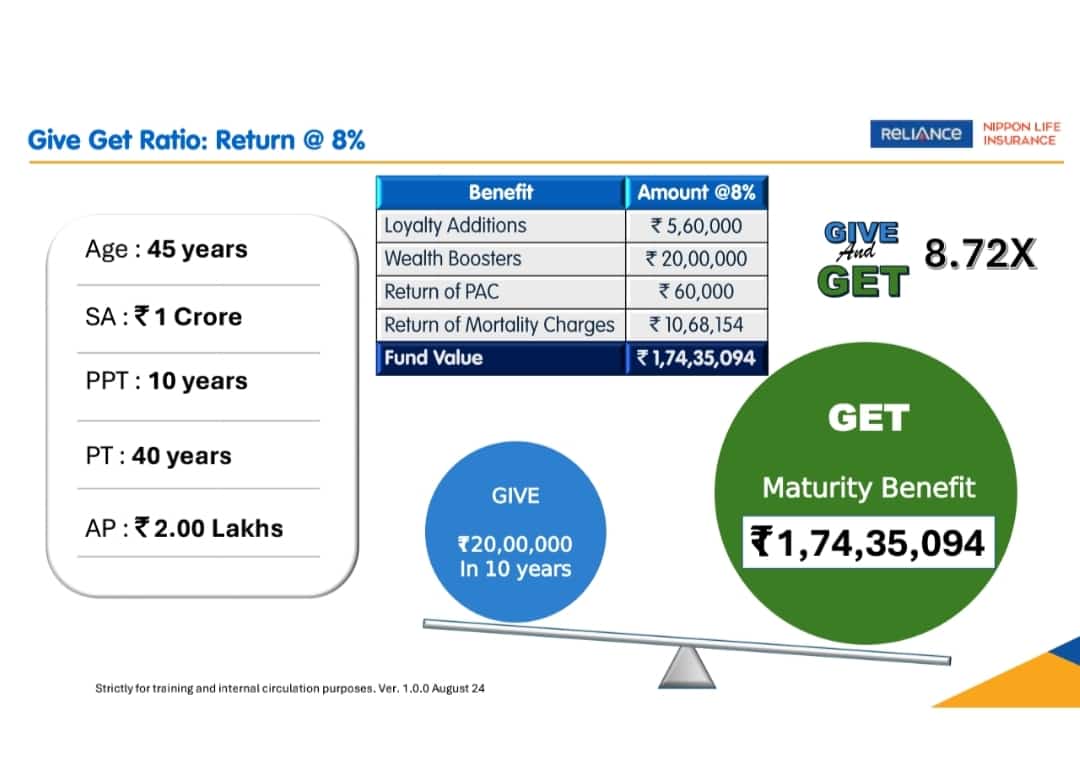

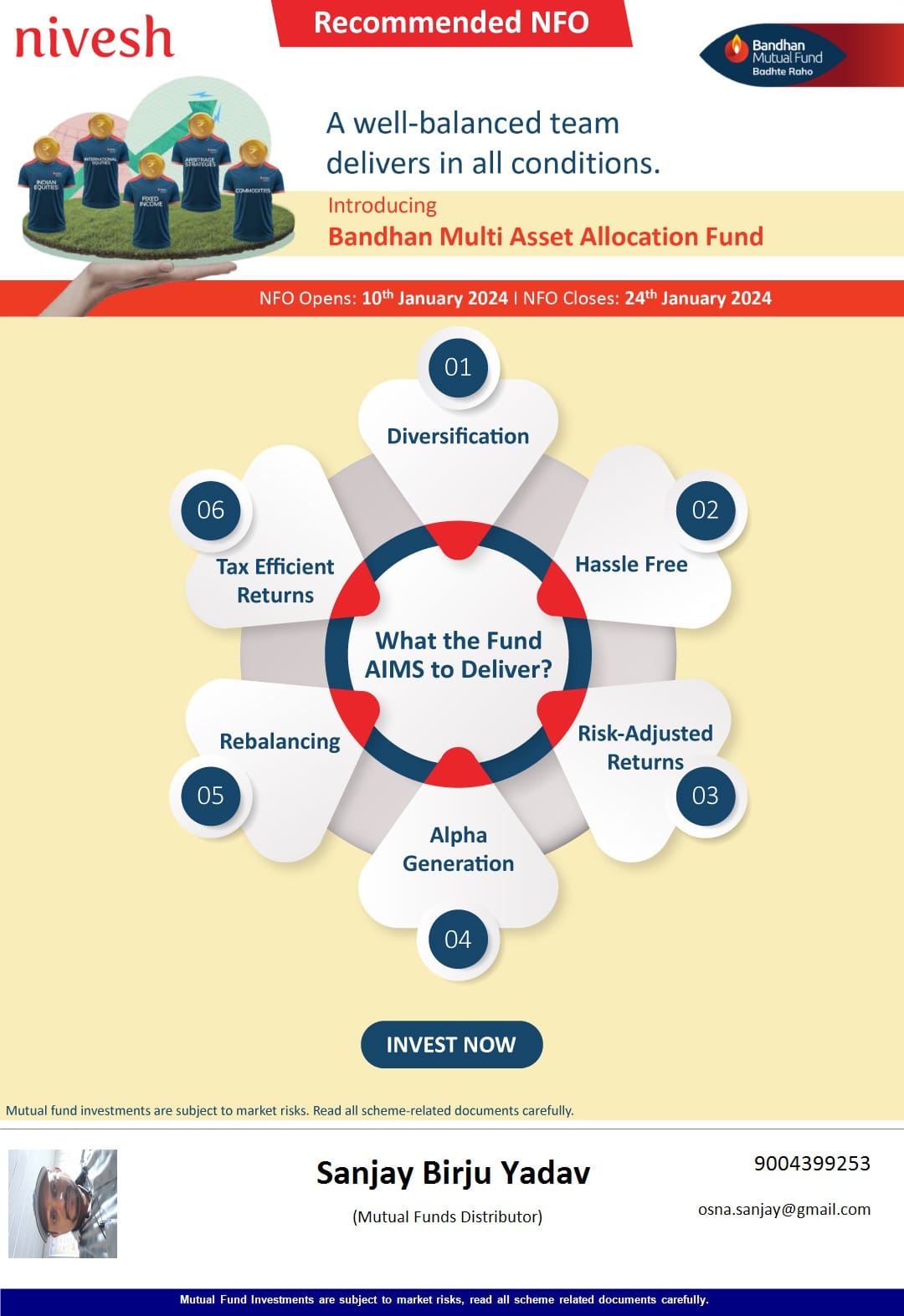

What is the fund's AIMS to Deliver?

- Multi Asset Allocation is an investment strategy that optimizes risk and reward by diversifying a portfolio across various asset classes.

- Each asset class plays a unique role within the portfolio, providing potential growth, stability, or inflation protection.

- Importantly, each asset class responds differently to market cycles, so while some may underperform, others might thrive at any given time.

- As a result, a combination of asset classes leads to potentially stable portfolio returns.

- A pivotal 1986 study emphasizes that asset allocation is the single most important factor in determining portfolio outcomes.

- A staggering 92% portfolio return variability is determined by asset allocation.*

- On the other hand, security selection and market timing have negligible impact on return variability.

Multi Asset Allocation Fund

FAQ -

While there is nothing wrong about investing in mutual fund NFOs, there are certain popular myths and fallacies that investors must get over. That gives you a better and more rational platform to assess the merits and demerits of a mutual fund NFO.

You should look at various factors such as the reputation of the AMCs, the expected returns, risk factors, asset allocation and the objectives of the NFOs and make an ideal decision.

It isn’t a matter of difference, as they aren’t comparable. NFO stands for a new fund offer. In an NFO, a new fund is launched and offered to the public. It is only a statement about what the fund is planning to do and therefore, it has no history

Investing in an existing fund is preferred over an NFO because an existing fund has a proven track record, whereas an NFO is a completely new fund with no past record.

NFO: Advantages And Disadvantages

The prime advantage of the NFO is that it provides access to new types of mutual funds. Along with the access to new funds, the disadvantage of NFO is that there are no past records and performances on which investors can rely their decision upon.