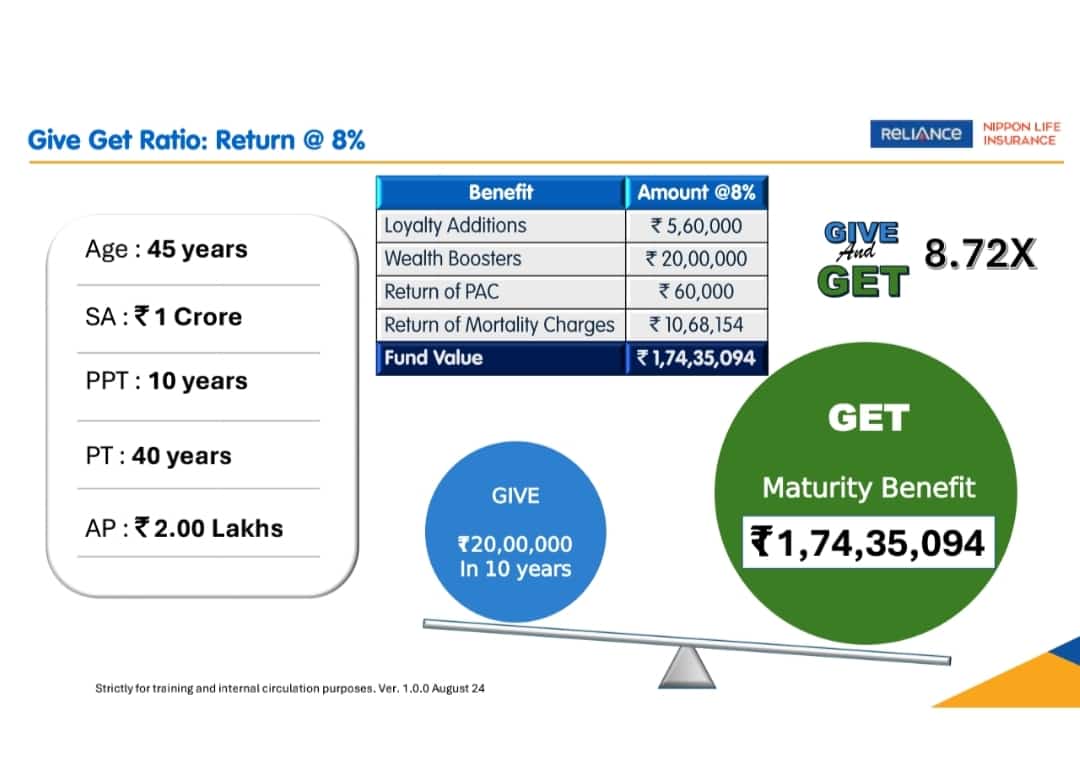

1) Get 8X Returns with ₹1 Crore Life Cover Policy Details:

- Policyholder’s Age: 45 years

- Sum Assured (SA): ₹1 Crore

- Premium Paying Term (PPT): 10 years

- Policy Term (PT): 40 years Annual Premium (AP): ₹2,00,000

- Total Premium Paid (GIVE): ₹20,00,000 (over 10 years)

2) Get 8X Returns with ₹1 Crore Life Cover Projected Returns (Assuming 8% Return)

- Loyalty Additions: ₹5,60,000 These are rewards for staying invested in the policy.

- Wealth Boosters: ₹20,00,000 Special additions to enhance fund value.

- Return of PAC (Policy Administration Charges): ₹60,000 Refund of policy administration charges.

- Return of Mortality Charges: ₹10,68,154 Refund of mortality charges if the policyholder survives the policy term.

3) Get 8X Returns with ₹1 Crore Life Cover Maturity Benefit (GET):

- Fund Value at Maturity (at 8% return): ₹1,74,35,094

4) Get 8X Returns with ₹1 Crore Life Cover Give to Get Ratio:

- GIVE: ₹20,00,000 (Total premium paid in 10 years) GET: ₹1,74,35,094 (Maturity benefit) Give to Get Ratio: 8.72x For every ₹1 paid, you receive ₹8.72 at maturity.

5) Get 8X Returns with ₹1 Crore Life Cover Important Points:

- Long-Term Investment: A 40-year policy term that works well for retirement planning and asset accumulation.

- Life Cover: ₹1 Crore sum assured provides life insurance cover throughout the policy period.

- Returns: The rewards of maturity include wealth enhancements, charge refunds, and loyalty adds. Tax

- Benefits: Section 80C may allow premiums to be deducted from taxes, and Section 10(10D) may, under certain circumstances, exempt the maturity payout.

These Are Get 8X Returns with ₹1 Crore Life Cover and Guaranteed Benefits Important Points.

* Reliance Nippon Life Insurance Other Fund *

Summary

Get 8X Returns with ₹1 Crore Life Cover and Guaranteed Benefits :-For those looking for long-term wealth growth as well as life insurance coverage, Reliance Nippon Life Insurance provides a comprehensive solution with this policy. With a ₹1 crore guaranteed sum and a ten-year premium-paying period, the policyholder invests ₹2,00,000 a year for a total of ₹20,00,000 over the premium term. The maturity benefit, which includes loyalty enhancements, wealth boosters, the return of administration and mortality charges, and other benefits, amounts to ₹1,74,35,094 at an anticipated return of 8%. In actuality, the insured receives 8.72 times the total amount of premiums paid. This 40-year plan, which offers significant life insurance and possible tax advantages under Indian tax regulations, is perfect for long-term financial security and retirement planning.

And More Benefits

The Peace of Mind That Comes with Financial Security

The Foundation of Financial Success

Expert Guidance on Life Insurance Planning

Pros of Life Insurance:

- Financial Security for Dependents:

- Benefit: In the event of the policyholder’s death, life insurance provides a financial safety net for beneficiaries, ensuring they can cover essential expenses, maintain their lifestyle, and meet future financial goals (e.g., education, mortgage).

- Peace of Mind:

- Benefit: Knowing that loved ones are financially protected provides emotional comfort and reduces anxiety about the future. This peace of mind allows individuals to focus on their present lives without constant worry.

- Tax Benefits:

- Benefit: Premiums paid on life insurance policies are often tax-deductible under Section 80C in India, and the maturity proceeds can be tax-exempt under Section 10(10D), making it a tax-efficient investment option.

- Investment Component:

- Benefit: Certain life insurance policies, such as endowment or whole life policies, include an investment component that can grow over time, potentially offering a lump-sum amount at maturity, as seen with the loyalty additions and wealth boosters in Rahul’s case.

- Coverage for Loans and Debts:

- Benefit: Life insurance can help cover outstanding debts, such as home loans or personal loans, ensuring that family members are not burdened with debt after the policyholder’s passing.

- Estate Planning:

- Benefit: Life insurance can be an effective tool for estate planning, ensuring that heirs receive a tax-free inheritance and providing liquidity to cover estate taxes.

- Customization:

- Benefit: Policies can often be tailored to meet specific needs, including riders for critical illness, accidental death, or disability, adding further layers of protection.

Cons of Life Insurance:

- Cost of Premiums:

- Drawback: Depending on the policy type and coverage amount, premiums can be expensive, especially for older individuals or those with health issues. This might lead to financial strain if not budgeted properly.

- Complexity of Policies:

- Drawback: Life insurance policies can be complicated, with various terms, conditions, and exclusions. Understanding the fine print can be challenging, and individuals may not fully grasp what is covered or excluded.

- Long-Term Commitment:

- Drawback: Life insurance typically requires long-term commitment, which may not be suitable for everyone. Some individuals may find it difficult to maintain premium payments over an extended period.

- Potential for Lower Returns:

- Drawback: While life insurance can serve as an investment, returns may be lower compared to other investment options, such as mutual funds or stocks. This can be a disadvantage for those seeking higher growth.

- Limited Liquidity:

- Drawback: Accessing funds from a life insurance policy before maturity may not be straightforward. Early withdrawals can result in penalties or loss of benefits, making it less liquid compared to other financial instruments.

- Risk of Lapse:

- Drawback: If premiums are not paid on time, the policy may lapse, resulting in loss of coverage and benefits. This is particularly concerning if unexpected events occur during the lapse period.

- Not a One-Size-Fits-All Solution:

- Drawback: Life insurance is not suitable for everyone. Individuals without dependents or those with sufficient savings may not need a life insurance policy, making it important to assess personal financial situations carefully.

There Are Many Pros and Cons Related of Get 8X Returns with ₹1 Crore Life Cover and Guaranteed Benefits.

Get 8X Returns with ₹1 Crore Life Cover and Guaranteed Benefits FAQ

What exactly is life insurance, and what makes it crucial?

How does the system for paying premiums operate?

How is the Sum Assured calculated, and what does it mean?

What are wealth boosters and loyalty additions?

How are the benefits of maturity determined?

What does the ratio of give to get mean?

Are life insurance policies subject to any tax benefits?

What occurs if I neglect to pay my premium?

Can I remove money from my life insurance policy before maturity?

When selecting a life insurance policy, what factors should I take into account?

The Importance of Life Insurance: Securing Your Family’s Future

Life insurance is a crucial financial tool that provides peace of mind and security for your loved ones. By investing in a life insurance policy, you ensure your family is protected from financial hardships in the event of your untimely death.

In the event of the policyholder’s passing, life insurance offers a lump-sum payment, known as the Sum Assured, to the beneficiaries. This amount can cover essential expenses, such as daily living costs, mortgage payments, and children’s education. It acts as a safety net, allowing your family to maintain their standard of living during a difficult time.

Moreover, many life insurance policies include additional benefits like loyalty additions and wealth boosters. These features can enhance the overall maturity value of the policy, providing an opportunity for your investment to grow over time.

By planning ahead and investing in life insurance, you can enjoy peace of mind. You will know that you have taken steps to secure your family’s financial future. In a world filled with uncertainties, having this protection is a responsible decision that reflects your commitment to your loved ones.